Financial mechanisms

Talk of regeneration tends to remain technical or idealistic. But to scale, we need to speak the language of capital.

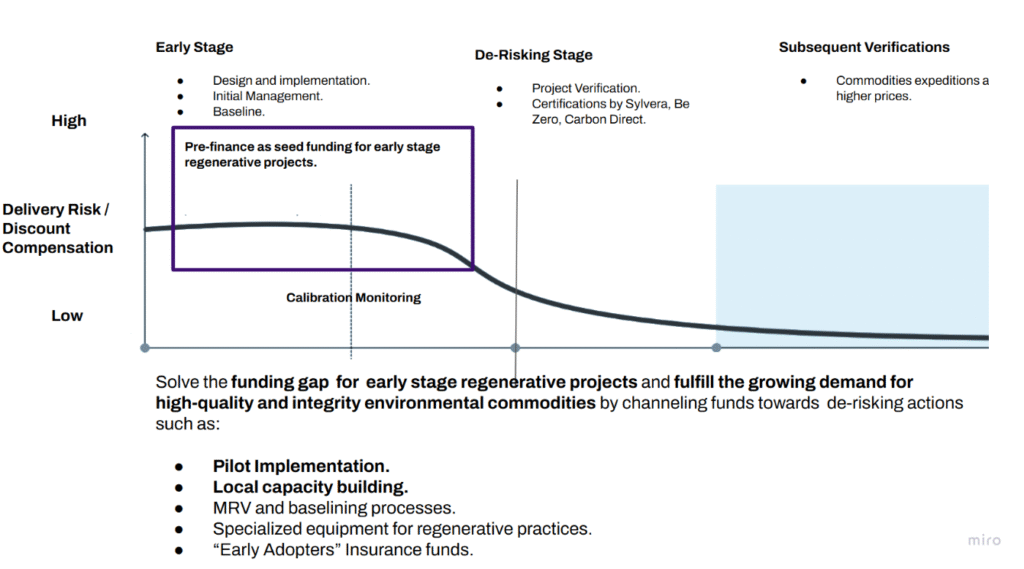

In its report “Financing for Regenerative Agriculture,” The Rockefeller Foundation highlights new tools to close the financing gap in the field: concessional guarantees, bridge loans backed by purchase agreements, responsible commodity funds – such as deforestation-free soybeans – and catalytic capital willing to take the first loss to attract institutional investors.

These instruments already exist. But the problem is not only financial, it is one of reliable and standardized information.

That’s why at Havona we take an additional step: we transform regenerative data into financial assets. We issue blockchain certificates on soil organic carbon sequestration (COS), turning it into a digital commodity with traceability and clear technical standards. This asset can back carbon forward contracts, insurance policies or even be collateral in green loans.

In other words: we connect the complexity of living systems with the logic of the market. And we do so without oversimplifying or losing technical rigor.

Regenerative agriculture is not the risk. It is the best hedge against climate risk.

Calculate your project potential for free

Schedule a free call with one of our specialists to start with a carbon sequestration potential calculation.